We know once you buy your first home you probably start to set your sights on the next goal, whether it be a bigger house, a new car? an investment property? You might be wanting to review your finances to check you are still on the best deal?

WE DO IT ALL.

LOANS FOR FIRST HOME BUYERS

Owning your own home is the Great Australian Dream. We specialise in helping First Home Buyers and have helped many Aussies get onto the property ladder and into their first home.

Purchasing your first home is a huge milestone and something to be proud of. It can be very exciting and overwhelming at the same time. Our job is to hold your hand along the journey and make it a fun, easy experience.

We can help you to avoid any costly mistakes and get you the best deal possible from a lender that suits your needs.

We even help First Home Buyers who aren’t ready yet but just want advice about how to plan for their future.

We are happy to offer free consultations to anyone with a dream to purchase their first home. It doesn’t matter if you are not quite ready yet. It is much better to speak to us early so we can help put a plan in place to help you reach your dream quicker.

We have years of experience assisting First Home Buyers with Guarantor Loans and First Home Owner Government Grants and can advise on all of the options available to you.

We have built up a team of trusted partners from our years of working in the industry and can recommend Solicitors, Real Estate Agents, Buyers Agents, Build and Pest Advisors if required.

NEED A NEW CAR, HOLIDAY, HOME RENOVATIONS OR DEPOSIT FOR NEXT PROPERTY?

A mortgage top-up can be helpful if you want a new car, home needs a little renovation or your might want extra money for a holiday or a wedding.

Or you might want extra money as a deposit to purchase another property. We can work out how much useable equity is available in your home and figure out best lending options to help you get the extra cash you need to purchase that next property.

✓ Purchase another property

✓ Investing in stocks or sharemarket

✓ Buying a new car, boat or caravan

✓ Pay for a holiday

✓ To keep funds on standby for maternity leave

✓ Buying a business

✓ Debt consolidation

✓ Renovating your home

✓ Pay for medical expenses

✓ Pay for a Wedding

CHECK IF YOU CAN SAVE MONEY BY SWITCHING YOUR CURRENT HOME LOAN

It's truly amazing how much money you can save by reviewing your current mortgage. There is often literally thousands of dollars of savings to be had just simply by requesting a rate reduction with your current lender or by moving to a different lender. Let us work out if we can save your money on lowering your mortgage repayments. The trick is to know the right lender to go to at the right time. Let us do all the research. We keep up with bank policies, lending criteria and rates to ensure we are on top of our game to give you the best options out there.

The home loan market doesn’t stand still. New products and rates are constantly changing as lenders compete for business.

We can assess your existing loan to determine whether a change in product could save you money to pay off your debt faster. Or simply to confirm whether you are better off sticking with your existing lender.

We will actively manage your mortgage for you, contact you every 6-12 months and if there's a better deal out there for you, bet your bottom dollar we’ll find it.

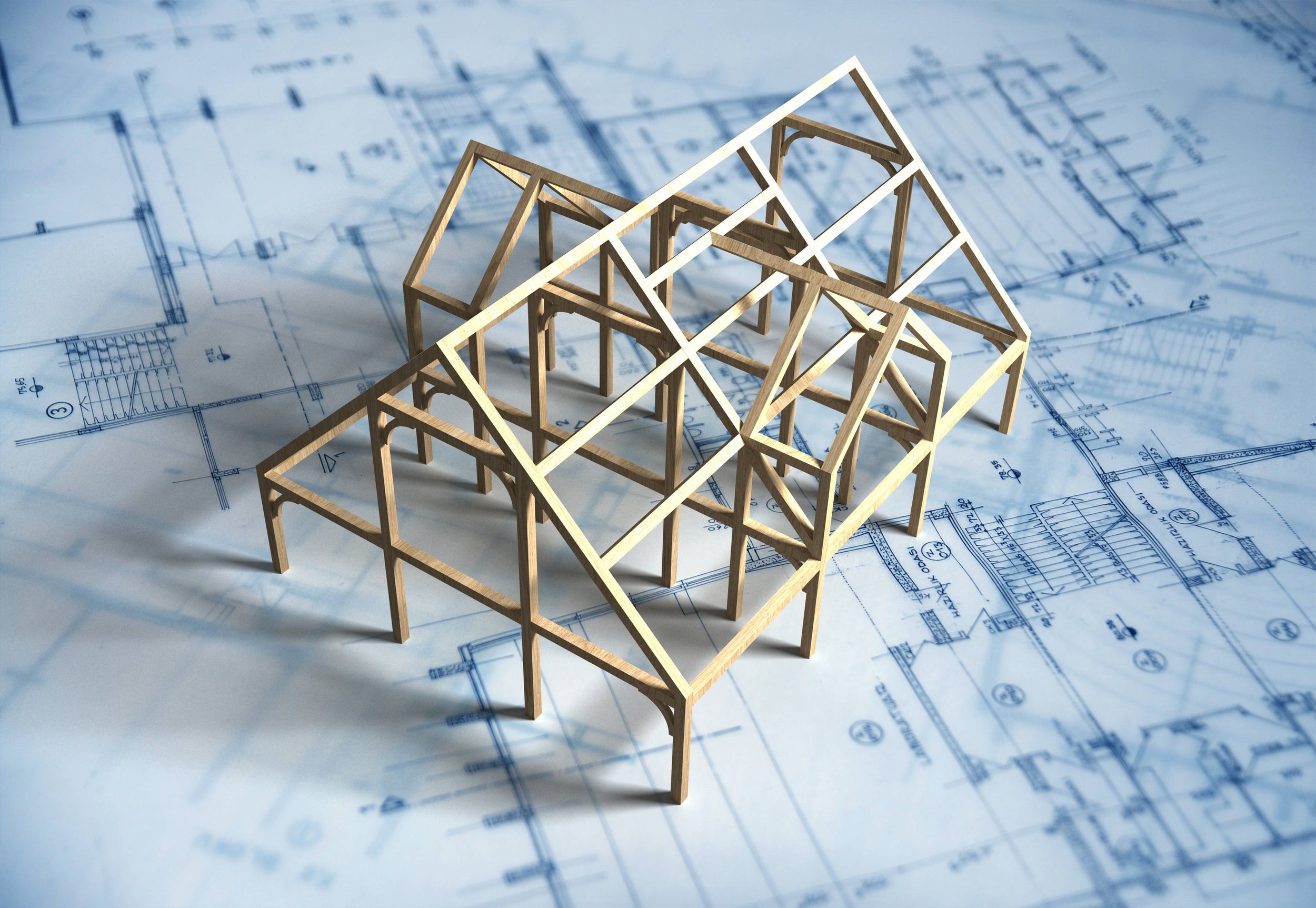

LOANS TO BUILD A NEW HOME

Purchasing some land and building that dream home can be an exciting time but it can also be very stressful. Getting a lender to approve finance for a new building is a little different to an approval for an established property. Lenders have different requirements and conditions on finance with land and build applications.

Building Contracts are required to confirm the construction stages and amounts payable on completion of each stage. Your builder invoices for each stage completed and the bank will check off each stage and pay each invoice before the next stage commences. We understand the building process, the contracts and the construction loan process from different lenders and can support you by managing your finances so you can focus on more important things like colour schemes and planning your first summer BBQ.

LOANS TO PURCHASE AN INVESTMENT PROPERTY

Property is a long-term investment, and we can help you achieve your financial goals and develop an investment strategy towards achieving them.

We can help you consider all your residential property investment options and assist with using available equity in your current home to purchase investment property. We can also recommend and arrange meetings with valuers, accountants and lawyers.

We have built up a trusted network of associates in the wider Finance Community that we can refer on if required.

Typical professions we work with:

Real Estate Agents

Insurance Advisors

Financial Advisors

Accountants

Lawyers

Pest and Build Advisors

Builders

Property Buyers